Taxes Levied On IT Jobs In The US

QuBY2E | February 1, 2021 | 0 | BlogEvery Salaried Person Is Levied A Tax

In recent years, IT jobs in the US have mushroomed. So have the annual pay that comes with these roles. While most job seekers come to our site to check out the highest salary tech jobs, they rarely think about their tax burden.

We help on that front by talking about the federal income tax levied on salaried people. But before we dive into the current tax brackets and what rate will be applied to your salary, here is a short history.

The current federal income tax has a 100+ year history. Congress ratified it under the 16th Amendment in 1913. Before that, short-lived income taxes were used.

The number of tax brackets and rates applied have zigzagged dramatically in those 100 years. Initially, there were only 7 brackets. In 1920, that changed to 50. Till 1970, the brackets varied, but they never went below 20. It was in 1986 that the brackets went from 16 to 2 with the Tax Reform Act. In the past three and a half decades, the brackets increased again to reach the current 7.

The Current Income Tax Brackets And Their Rates

At present, the individual income tax has seven brackets. The federal tax rate can range from as low as 10% to as high as 37%. This rate is applied to your taxable income, which is your gross income minus:

- allowable itemized deductions

- standard deduction

Any income up to the standard deduction has a 0% tax rate.

The progressive income tax rate

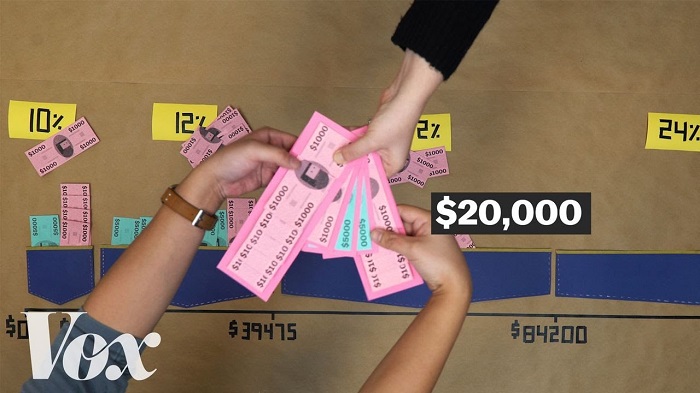

Federal income tax brackets are progressive. It means as the salary of your tech job increases, the more tax you pay. That is why there are different brackets or ranges. So, for instance, if your taxable income is more than $518,400, then your tax rate is 37% – if you are a single filer. In case you file jointly as a married couple, then the highest tax bracket is for over $622,050 taxable income.

Single filers

| Rate | Taxable income |

| 10% | $0 to $9,875 |

| 12% | $9,876 to $40,125 |

| 22% | $40,126 to $85,525 |

| 24% | $85,526 to $163,300 |

| 32% | $163,301 to $207,350 |

| 35% | $207,351 to $518,400 |

Married, filing jointly

| Rate | Taxable income |

| 10% | $0 to $19,750 |

| 12% | $19,751 to $80,250 |

| 22% | $80,251 to $171,050 |

| 24% | $171,051 to $326,600 |

| 32% | $326,601 to $414,700 |

| 35% | $414,701 to $622,050 |

| 37% | $622,051 or more |

For married individuals who file separate tax returns or people who file as heads of household, the rates, and the additional tax schedules are different. Similarly, for any dividend, you get in a year or capital gains, there is a separate tax rate. Lastly, all tax brackets are adjusted for inflation every year.

How Does Progressive Income Taxation Work?

Check Out – The basic concept of progressive taxation is that each rate applies to the income in a particular bracket. So, let’s say your taxable income comes to be $65,000 this year. You will not be taxed 22% for the entire amount, i.e., 22% of $165,000.

Rather it will 10% of $9,875 (the first bracket) + 12% of $30,250 ($40,125 – $9,875, the second bracket) + 22% of $24,875 ($65,000 – $40,125, the third bracket). This ensures that even if you fall under the top tax bracket, at least part of your income is taxed at a lower rate. This is helpful if you reach a new bracket.

Here, a point worth noting is that the income range in each bracket differs for single filers and a married couple. For married taxpayers, the brackets are double the size of singles. There is an exception to this rule – the sixth bracket or the one below the highest one.

This causes the ‘marriage penalty’ and the ‘marriage bonus.’ The marriage bonus is paying less tax by filing your income returns together rather than filing them as single people. The penalty is if you fall under the highest tax bracket, then you end up paying more tax as a couple compared to what you would pay if you filed separately.